Utilising open banking infrastructure

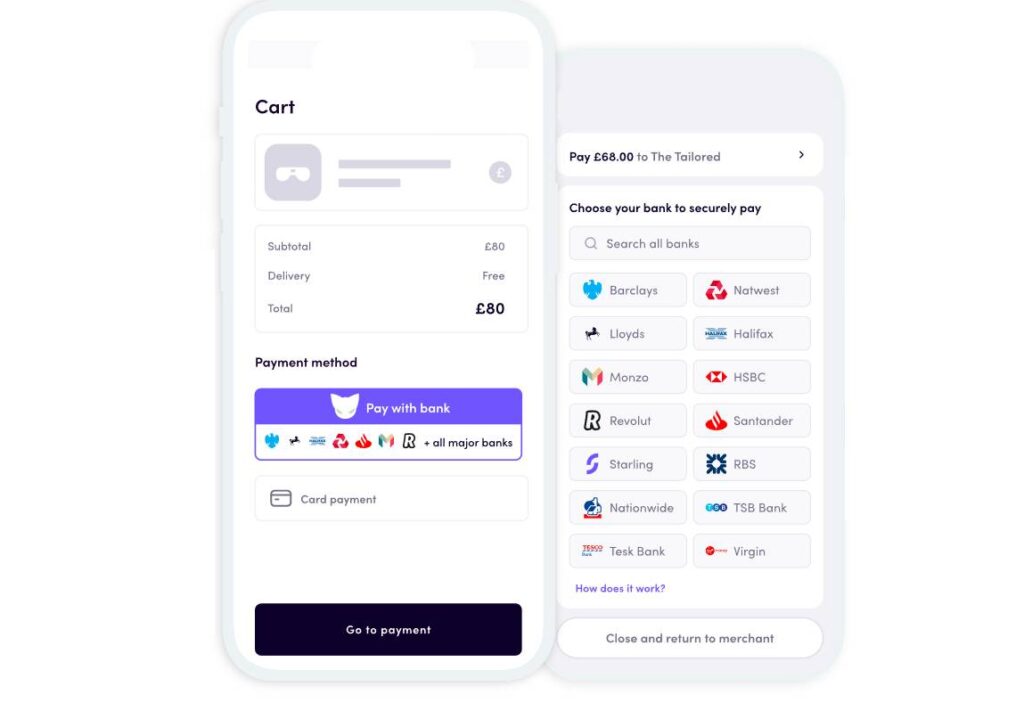

Enable your customers to swiftly pay from their bank accounts using our in-house solution, seamlessly enhancing your current payment offerings.

Why Your Business Needs an Open Banking Solution?

Broaden your checkout process to seamlessly accommodate real-time payments.

Enhance Customer Experience

Give customers payment options while also getting the benefit of instant merchant settlement

Minimize Risk

Enable customers to pay directly from their bank and reduce the number of chargebacks

Reduce Cost

Lower the cost of transaction processing fees by routing payments through the banking network

uptime

0

%

fraud prevention rate

0

%

of banks in the UK & EEA

0

%

An unrivalled Open Banking ecosystem

Make it easy for your customers to pay using their bank information during checkout. No more confusing steps – just enjoy higher conversion rates, lower costs, and increased security.

How does Open Banking eliminate chargebacks?

In Open Banking payments, customers transfer funds directly between accounts, bypassing payment cards. This eradicates chargeback risks entirely, while two-step authentication adds an extra layer of security, minimizing the chance of accidental payments.

Which countries are covered?

Which currencies are available with Open Banking?

EUR & GBP

Take payments to the next level

Reduce transaction costs, eliminate chargebacks, and enjoy prompt payments directly to your bank account.

Discover how Open Banking can fuel the growth of your business

Please complete the form and one of our payments experts will be in touch shortly!